Mexico: A Country in Transition

The Market: A Cultural and Financial Opportunity for Point-of-Use Water Dispense

When it comes to beverages, Mexico is unique in many ways; driven in some instances by the culture – the highest per capita consumption of carbonated soft drinks, 163 liters/year (40% greater than the US!, 1/3 the population). In the case of drinking water, it is common knowledge to anyone who has traveled to Mexico the recommendation to not drink the water, a recommendation that is rigidly adhered to by the locals as well.

For this reason Mexico has the largest per capita consumption of bottle water in the world, 243 liters per person – the US consumption is 110 liters per person. It becomes little surprise that in 2011 bottle water sales were $9 billion, and expected to reach $13 billion by 2015 – making Mexico the world’s largest bottle water market (in dollar terms). However, what is more surprising is that 70% of the volume of bottle water consumed is consumed in large volume bulk "garrafones" (20 liter jugs)!

An Emerging Middle Class

A January 2012 publication (Mexico: A Middle Class Society – Poor No More, Developed Not Yet - Luis de la Calle, Luis Rubio) elaborates the awareness by two Mexican economists, and their subsequent investigations into the causal relationships that are driving the metamorphosis of a sizable portion of Mexico’s populace into an emerging middle class society. By some measurements as much as 50% of the populace is enjoying the benefits of these phenomena.

“…the middle classes of practically all modern societies, and all developed ones, share a common characteristic: those who are part of the middle class earn enough income to live in an urban environment and want to systematically improve their social and economic standing.”

- Luis del la Calle, Luis Rubio

More recently, in June 2013, INEGI (Mexico's statistics institute) published their first "provisional report" on the analysis and quantification of the middle class. This analysis suggests that the middle class is not quite as large, reaching 39.2% of the population (42.4% of the homes). The report goes on to state, however, that if we just capture urban population statistics the number reaches 47.0% of the population (50.1`% of the homes); bringing the numbers closer to findings of the Luis de la Calle / Luis Rubio study. (Boletin de Investigacion Num. 256/13: Clases Medias en Mexico)

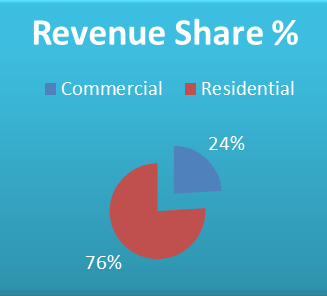

What is the target market share value for the Residential and the Comercial sectors?

In general, 76% of the refreshment market is consumed at home, with the balance consumed either ‘on-the-go’ (sports, special events venues, etc.), and at work. Since our focus is the garrafone package, the ‘on-the-go’ market segment is not currently a package segment of interest. Single serve packages account for 30% of the overall market.

We can then take the garrafone market share (70%, or $7 billion) and assume that 76% ($5.32 billion) of this package segment is for the At-Home market. Hence the balance of the volume (24%, $1.68 billion) of the segment can be attributed to the At-Work (commercial) share of the pie.

How does the Residential (home delivery) market break-out?

Primary market research [+ our unofficial survey] indicates that 73% of the At-Home market utilizes home delivery of garrafones. (NOTE: our survey suggests this could be as high as 80% with some demographics). The cited research indicates that 69% of this segment consumes two to four (2 – 4) garrafones per week (or 8-to-16 per month), while 16% consumes five to seven (5 – 7) garrafones per week (or 20-to-28 per month).

The supply (purchase) decision criteria may be identified by either “trademark”, “flavor”, or “price”; yet ultimately, the primary selection factor is truly price. We say this because when the preferred brands are identified in the survey, 80%+ of the consumer preference is cited for oligopoly brands (Coke, Nestle, etc.). These products are quality-equivalent (i.e., they come from RO treated water) and competitive in flavor selection and price. In our view, price (brand) is the only true differentiator in the bottled jug package; driven by consumer desire for a safe, consistent source of water quality. Our market survey conducted in Mexico City shows that the higher-end of the price range for a garrafone is 28 pesos (~$2.50 US).

We will focus on the High-End, High Consumption segment of the At-Home market

This “high end” At-Home market segment can be projected to pay from $50/month (20 garrafones @ $2.50) to $70/month (28 garrafones @ $2.50). The share of this High-Consumption segment of the At-Home market is 16%; this translates to $850,000,000 (0.16 x $5.32 billion).

What is the dynamic of the commercial market sector; will it support the transition to POU?

We have deduced that the Commercial market sector for garrafones delivery has a value of approximately $1.68 billion [See Chart Above]. The higher volume outlets would be our target prospects – these are customers that already pay $80-$100+ per month. The transition to POU with a premium-priced leasing framework will be positioned with fixed prices against the inevitible of incremental consumption volumes. Though the financial value of ‘intangible’ benefits, e.g. space savings, office / plant security, continuous supply without interruption etc., could also be a big driver.

The question then becomes: “How many dispense points will be needed per high volume outlet?” – and in parallel, “What is the typical average consumption per dispenser in this type of venue?”

Our research approach taken here was to identify examples of large volume outlets, quantify the number of dispense points, and then calculate the average monthly consumption of garrafones per dispense point.

We were able to identify two distinct government documents (either RFQ or PO) for garrafone purchase that provided this information. In each case, the documents provided a range of proposed consumption (Min-Max average per machine). The declared range was 25-to-64 garrafones per month per dispenser (6.25 to 16 per week).

At this moment, the population of Offices with our target consumption volume is unknown, further investigation will need to be done to capture precise numbers. However, when we conservatively consider a Sales Strategy to penetrate the top-of-pyramid in this channel segment (15% to 20% of all Office accounts), we consequently could value this segment at $250,000,000 to $340,000,000. Most important, this channel demographic would fulfill our target lease pricing parameter (delivering high double digit % margins).

What is the market value of this proposed transition to POU?

In summary, we have conservatively identified that the target market segments (residential and commercial) potential – defined primarily by premium lease pricing – are valued from $1.1 billion to $1.19 billion. [$850,000,000 + $250,000,000 = $1.1B; $850,000,000 + $340,000,000 = $1.19B]

The grand opportunity in Mexico is to establish Point-of-Use (POU) dispense as the new normal; the accepted standard for drinking water at home and at work. Our plan to create a $25+ million POU business in 5 years will only capture 0.40% of the garrafone market; however, this will make the necessary impact to draw the attention of the Brands to enter this lucrative, emerging market via acquisition of aguaOzone, the market leader for next generation potable water delivery.